For many, the 2020 election was primarily tied to the presidential race. However, many important ballot questions appeared in states across the country. In Illinois, a ballot initiative, dubbed by supporters as the “Fair Tax” amendment, sought to amend the Illinois state constitution to abolish the flat income tax and replace it with a graduated income tax. Though it might sound simple, campaigns concerning the ballot question saw over $100 million of investment. In the end, the tax amendment was rejected by a 10% margin at the polls.

Is a flat tax system ethical? What are the values and detriments of taxing income at the same rate?

Only 9 states in the U.S. enforce a flat tax rate. These states are spread across the U.S. and across the political spectrum, from Massachusetts and Colorado to Utah and Kentucky. In terms of flat income tax states, Illinois is on the higher end of the tax rate, charging 4.95% of its residents’ income levels.

One moral argument for the flat tax rate is that on its face, it appears extremely fair. Everyone, regardless of income level, is expected to contribute an equal share of their earnings to the local government. A flat tax is also considered to prevent deadweight loss, and the unintended consequences that follow from it. Those who believe that our economy is meritocratic — where labor leads proportionally to profit — might favor a flat tax because it does not constrain those who choose to labor more and therefore profit more.

Another value of the flat tax is that it is easy to understand and implement. Individuals do not have to worry about whether or not their next bonus at work will push them over the edge into the next tax bracket. The flat tax rate has also been considered good for both the middle class and the upper class, or the “job creators.” Those who subscribe to free market ideology believe that a flat tax is the most acceptable form of income tax in that it does the least to inhibit the efficient allocation of resources which already occurs naturally through free-market processes. Flat tax rates have also been found to stimulate the economy through an increase in investment and consumption.

The relative value of eliminating line-drawing is also a benefit claimed by flat tax advocates. If everyone is taxed the same as principle, we can avoid the difficult, and at times arbitrary, process of determining which income levels warrant which levels of income tax. Supporters of flat tax rates might even point to examples of inequity caused by lobbying in graduated tax systems, such as the recent exemption in the 2018 tax plan, which rather unreasonably favored the food company Newman’s Own.

However, many argue that though flat tax rates appear on their face to be equitable, they actually contribute to inequality overall. For a person near or below the poverty line, 4-5% less income can make a substantial difference in lifestyle compared to the wealthiest members of society. For this reason, flat taxes are often considered as favoring the wealthy, as their lifestyle is affected far less than those at the bottom of the income bracket. When combining a flat tax rate with charitable exemptions, the wealthiest members of society might end up paying very little, which can put the burden of taxation on the middle and lower classes or lead to an overall shortage of tax funds with which to address social issues.

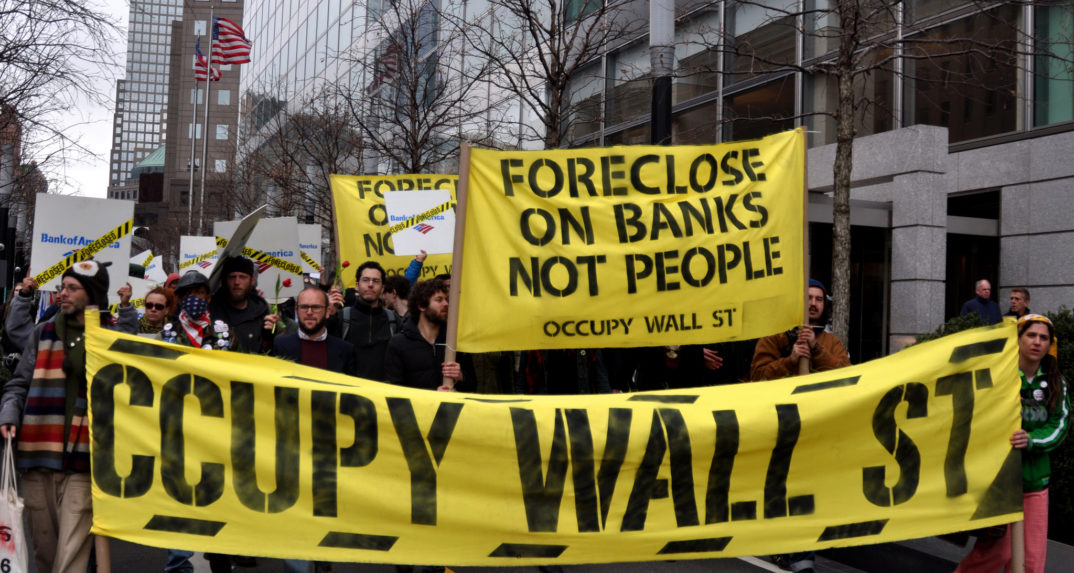

Those in Illinois who supported abolishing the flat tax believed it was the fairest policy for the most amount of people. In fact, 97% of all Illinois residents stood to have their tax rate stay the same or decrease as a result of the amendment. Only those individuals making more than $250,000 per year would see an increase in their income tax rate. However, the fair tax amendment did not pass, by roughly a 10% margin.

An Illinois local news agency, Forest Park Review, published interviews with Illinois residents debating the fair tax amendment. Those in Illinois who were against abolishing the amendment argued that once the precedent of graduated income tax was set, the Illinois state government could set new tax rates at any time. One such detractor, Dan Watts, also pointed to the fact that the state of Illinois has notoriously misspent and mismanaged the state budget and finances for years, and that the responsibility of this mismanagement should not fall back onto individuals in an attempt to “paint the water-stained walls.” Another detractor of the amendment, Dan Bjornson, expressed a similar distrust of government, justifying his opposition to the amendment by pointing out that “they’ve made a mess of the state’s finances and I would not want to give them additional power.” However, others argue that it is the very tax system itself that has created such budgetary crises at the state level. Fair tax supporter Quentin Fulks, the chair of the Vote Yes for Fairness campaign, purported that “Illinois is in a massive budget crisis due to years of a tax system that has protected millionaires and billionaires at the expense of our working families.”

Perhaps the greatest irony of Illinois’ ballot amendment is the fact that those heading both the pro- and anti-flat tax campaigns were themselves billionaires. Governor Pritzker invested $56 million to the “Vote Yes for Fairness” campaign. His campaign donation was nearly evenly matched by billionaire Ken Griffin, who poured $54 million into the “Stop the Proposed Tax Hike Amendment” campaign. It seems that the upper echelon of society is controlling the narrative when it comes to a policy that affects every individual. Perhaps it is time to examine a political system in which one’s income heavily dictates the power one wields in the democratic debate over regulating such income.