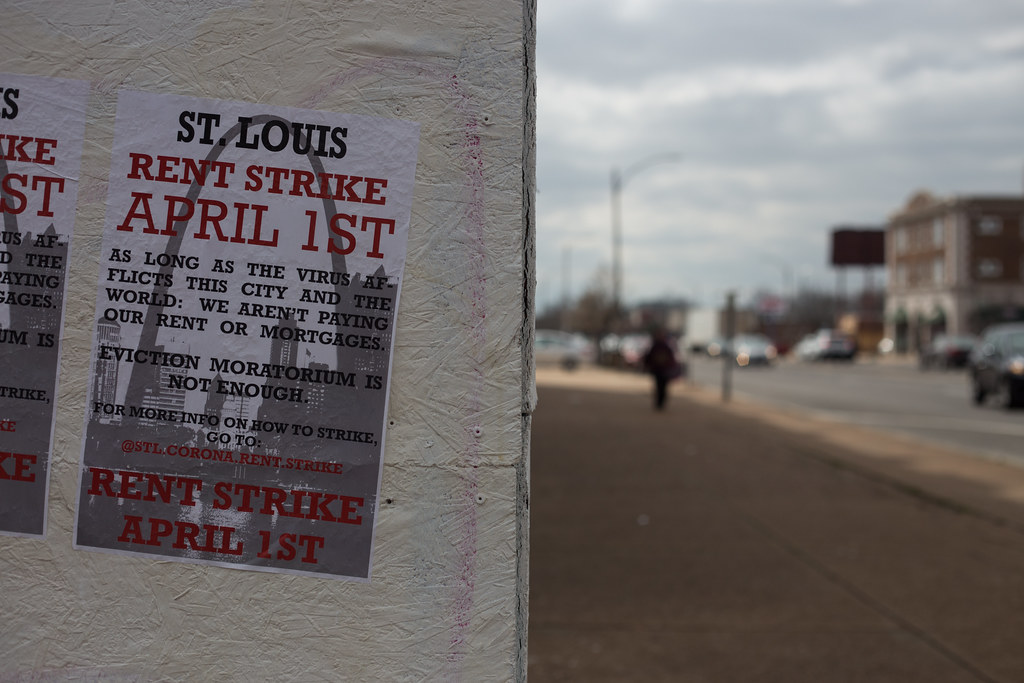

While unemployment numbers continue to skyrocket due to COVID-19, many are left with no ability to pay their rent. Despite states issuing moratoriums on evictions, some landlords have ignored these directives and proceeded to evict tenants anyway. When challenged with the illegality of their actions, a number of landlords have antagonized tenants in other ways such as shutting off their power.

On June 1st, many courts have reopened and are now processing a backlog of evictions which threatens an estimated 20 million Americans to be evicted by September 1st. As service workers are among the hardest hit from job losses caused by the pandemic, some landlords have even asked tenants to provide a full year’s worth of rent payments in advance, evoking an ironic punishment for their being in a particularly vulnerable position.

The rent crisis that the country is experiencing has strained already tense relationships between landlords and tenants who have been voicing their frustrations online, expressing anxiety about how to navigate an unprecedented situation.

“But Landlords Have Bills Too”

One of the most common reactions to the current crisis has been to argue that while it is true that tenants are struggling, landlords are also in financially precarious situations because “they also have bills to pay.” This points to the fact that at least some landlords do not own all their houses, but are still in the process of paying the mortgage. The implication of this line of reasoning is that one should not manifest empathy towards tenants exclusively because landlords are also experiencing financial insecurity. It is factually true that landlords have mortgages to pay, but the argument in support of the “bills” argument paints only half of the picture. The fact that landlords have mortgages means that they cannot afford to pay for the house they purchased in full. Hence the mortgage, and the debt. In an ideal world, one would never want to buy what one cannot afford; no one enjoys being in debt. Yet a middle-class individual often does not have any other choice than buying property with a mortgage. This is all the more sensible when it comes to buying one’s first home. Having a shelter — a place to rest and protect oneself — is a vital necessity for survival. But the same cannot be said of a second house. Such a purchase represents an investment, one whose profit goes on top of what one makes with their own job. No one is required to make such investments. But if it is correct that buying a second house is an investment, then there is a competing response to the “landlords also have bills” argument: landlords may have made a poor investment. That is, they bought a property that they did not have to buy, that they could not afford to buy in full, nor as a mortgage. Investments carry profit margins as well as risks.

“Don’t Rent What You Cannot Afford”

One could respond by saying that if it is true that landlords should not purchase property they cannot afford, then tenants should not rent apartments that they cannot afford. But their situations are markedly different. As workers, tenants utilize their labor to gain the financial resources so that their rent can be paid for. And if it wasn’t for the raising unemployment due to the pandemic, tenants would continue to pay their rent we usual. It could be argued that instead landlords were never really able to afford their second houses by relying only on their financial resources. Proof of that is that landlords do not employ their own labor in order to pay for their second house. They rely on the labor of the tenants who rent their property in order to pay for it. If that wasn’t the case, they would not need to rent the property at all. But they do need to rent it in order to be able to pay it off.

But the necessity of renting should also be taken in consideration. If one moves to a new city for a job, for example, one must find a place to rent. And this problem cannot be obviated by renting in an affordable place or by working remotely. Affordable apartments are harder to find in cities that provide job opportunities, and working remotely is not always possible. Even for international workers, some visas for example (like the J-1) have a residency requirement. So while it is necessary to rent an apartment to live in, it is not necessary to buy a second house.

“But Landlords Provide Essential Housing”

Another argument is that landlords face an unjustified backlash because, after all, by renting properties they are providing essential housing. But this line of reasoning is incoherent by its own lights. To start, there is a difference between providing housing and commodifying housing. Usually it is not the landlord who builds the rented property but the construction company. Thus, technically, it is the construction company that provides the house, the landlord instead commodifies it — meaning, the landlord turns the property into a source of profit.

Let’s also pause on the term “essential.” Something is essential for someone when the lack of it endangers their survival. In this sense, oxygen is essential. Likewise, water and food are essential because one cannot survive without those. Going even further, some believe that healthcare is essential because without proper access to medical care, one may not survive. A shelter is also essential in the sense that without it, survival is at least made more challenging. Thus, landlords are correct in arguing that housing is essential but precisely because housing is essential, this would seem a point against housing being commodified. This of course is not to advocate that canceling rent would be the default solution. As some have pointed out, the issue of how to protect renters is complex and no solution is immune from problems. The point is more that it is not obvious that renters can afford their apartment less than landlords can afford their second houses. Given that renters have lower incomes and less financial stability than landlords, their ability to nevertheless be able to pay for their housing, which is often more than half of their income, should speak in favor, and not against, their being financially responsible.

This analysis should not lead to a confrontational attitude towards landlords, but rather it should be viewed as an opportunity to reflect on yet another issue that the current coronavirus pandemic has forcefully made even more evident. In a world where rents and housing prices exceed personal budgets, the need of more affordable housing is not simply a problem for the future but one that urgently demands our attention.